The General Car Insurance Office Near Me – We appreciate your privacy. We may collect your personal data for business, marketing and cost purposes. Read more

We appreciate your privacy. We may collect personal information from you, such as identifying information (name, address, driver’s license number), data information (products or services purchased and including payment history), digital network activity (connection to our website, IP address), detailed information. , audio recordings and other personal information. We use this information for business, marketing and sales purposes, including providing the products and services you request, processing your complaints, preventing fraud, maintaining security, verifying your identity and providing insurance and financial products.

The General Car Insurance Office Near Me

For español, click below to cancel the version of Aviso de Privacidad del Consumidor de California. Read less

The General Car Insurance

Whether it’s a combination of auto, home, and life insurance, or ATV or RV insurance, State Farm has the insurance to fit your needs. With Personal Price Plan®, you can create the insurance that’s right for you. Footnote 1. New car insurance customers report savings of about $50 per month.

As long as you’re always on the go, life can be exciting and adventurous! State insurance in Houston, TX can help you stay on the move. Coverage options for many drivers include collision, coverage, liability, uninsured or underinsured motorist and medical expenses. Your final insurance needs will depend on many factors, including the type of vehicle you want to insure and your budget. With State Farm, you have options. We handle all types of vehicles, including cars and snowmobiles. We can help. Request an insurance quote in Houston to see premiums today.

Whether you rent or own, we can help protect your home with home and property insurance in Houston. Taking out home insurance involves a lot of trust. It can cover losses due to weather and sudden accidents. If your home is an apartment, there is home insurance that can protect your home from fire, theft and other losses. You don’t have to own a home to protect it. Renters insurance covers your belongings, such as your phone, furniture and electronics. If you own a car, you can save money by combining one of the policies above with State Farm auto insurance! More homeowners choose State Farm home insurance than any other insurance company. You can too. Get a quote to find out your insurance premiums in Houston.

Visit your nearest State Farm representative to learn more about your benefits today. We can help you protect the people, things and places you love.

Compare Car Insurance Quotes (october 2023 Rates)

1Return to index Costs associated with billing plans vary by state. Coverage options are selected by the customer, and availability and eligibility may vary.

2Return reference Average household savings based on State Farms’ 2021 national survey of new policyholders who reported saving by switching to State Farms.

Please note that the above description is an example of the coverages available and is not a contractual statement. All insurances are subject to applicable insurance conditions and approvals. Certification options may vary by state. For more information about auto insurance in your state, find a State Farm representative.

Discounts and availability may vary by state and eligibility requirements. Vehicles or drivers cannot receive payments. Finding the right insurance can take some driving, but our A-MAX insurance experts are here to guide you every step of the way.

Insurance Companies Offer Discounts For Having Gps Trackers

State law requires drivers to pay for accidents they cause. Most people meet this requirement by purchasing auto liability insurance. Liability insurance covers those who are injured in an accident you cause. It is necessary to repair or replace the property of the other driver.

Minimum insurance is not enough to cover your financial obligations if you are involved in an accident. You should consider increasing the coverage limits. However, increasing the insurance limits will increase your premium.

You should add collision coverage to your policy to cover your vehicle if it is damaged in an accident you cause (up to ACV limits). “Comprehensive” helps to repair or replace your vehicle if it is stolen or damaged by hail, fire, road debris, vandalism or covered accidents ( up to ACV limits). State law does not require full coverage or co-insurance. However, if you owe money on your car, your lender may want you to have this coverage. If your vehicle is damaged in an accident caused by another driver, the other driver’s insurance will pay for repairs to your vehicle up to the other driver’s insurance limits.

Driving without car insurance is against the law. Law enforcement requires you to show proof of your car insurance during a traffic stop. Your insurance company will give you an “insurance information card”, which is proof of your insurance. The card shows the basic features of your car insurance, including the start and end dates of coverage. The insurance card must be taken with you when driving. If you can’t provide proof of liability insurance, you could be fined, have your vehicle impounded, or have your driver’s license revoked.

Future Generali India Insurance Company Ltd In Chhatarpur,chhatarpur

The financial consequences of driving without insurance can be very serious. If you cause harm, you are financially responsible for any injuries or property damage. If a serious accident occurs, you may have to pay tens of thousands of dollars out of pocket. If you can’t pay the debt, you can be sued and the court can order the money to be deducted from your current and future income. Also, it can be assumed that the victim of the accident has a problem in receiving the necessary medical treatment for a full recovery.

No. All license applicants must show proof of insurance in order to obtain a license. You must show proof of insurance regardless of whether you are getting a driver’s license for the first time, renewing your driver’s license, or getting a driver’s license after moving. from another state.

You must provide proof of insurance when requested by the judges. The judge will ask you for proof of insurance if you are involved in an accident, regardless of whether you caused the accident or not. The police will also ask for a certificate if you have been stopped for a driving offense or any other reason. You must show proof of insurance when you get or renew your driver’s license, register your vehicle or have your vehicle inspected.

Each organization evaluates the risks differently. All businesses generally use some form of equation to consider “risky” behaviors. These often include driving history, age, gender and marital status, and sometimes credit insurance scores.

Top 10 Best Insurance Near Dickson, Tn

No. Insurance can be sold by any insurer or broker licensed by the Ministry of Insurance.

This website uses cookies to provide a personalized user experience. By using A-MAX, you agree to our cookie policy. You can learn more about our privacy policy here. Almost every state requires drivers to have auto insurance, so opting out isn’t an option – especially if you’re struggling to find an insurance company willing to provide you with coverage. . The insurance company in Nashville The General can be the choice for serious drivers who are looking for car insurance that fits their needs.

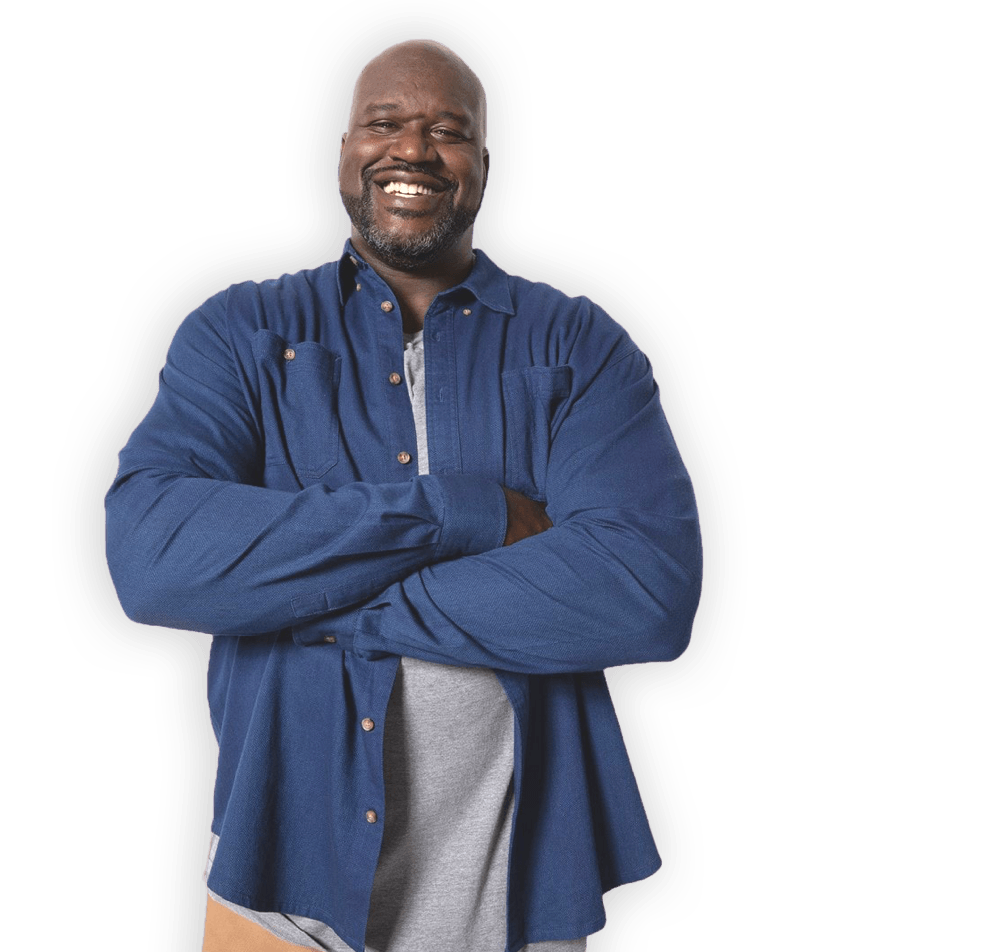

The Great company offers safety to advanced drivers and drivers with poor driving experience. Here’s what you need to know about The General, its prices, discounts and quality.

General has been offering insurance since its inception in 1963 under the name Permanent General Agency. It was only in 1997 that the company began selling insurance under a common name.

Cheap Auto Insurance Warsaw

Based in Nashville, Tennessee, General has regional call centers in Arizona, Louisiana and Ohio. In addition to auto coverage, General offers a full range of insurance options, including:

Generally speaking, he has reasonable car insurance rates and focuses on excellent customer service. It is known for providing coverage to people with bad credit and bad driving records. The company primarily sells insurance online or over the phone. Customers can get a custom car insurance quote online in minutes by providing some personal and vehicle information. Once you receive a quote, you can register and choose from the available insurance options according to your needs.

Like other insurance companies, The General benefits from the premiums paid by its customers and the rewards earned on investments.

Drivers must purchase the minimum liability insurance required by the government or car provider. General offers different types of car insurance for different needs, but its options are limited:

Cheap Car Insurance

You can request a quote online through the General website or at