How Much Is Car Insurance For A 18 Year Old – On average, an 18-year-old can expect to pay $356 a month in car insurance rates, which works out to $2,136 for six months. It is sometimes difficult to get cheap car insurance for young drivers due to their age. Although teen drivers have graduated from high school and are on their way to adulthood, the best auto insurance companies consider them high risk due to their lack of experience on the road.

The average cost of car insurance for an 18-year-old will cost more than that of an older driver. We’ve put together the cheapest car insurance options for an 18-year-old driver to help you through the process.

How Much Is Car Insurance For A 18 Year Old

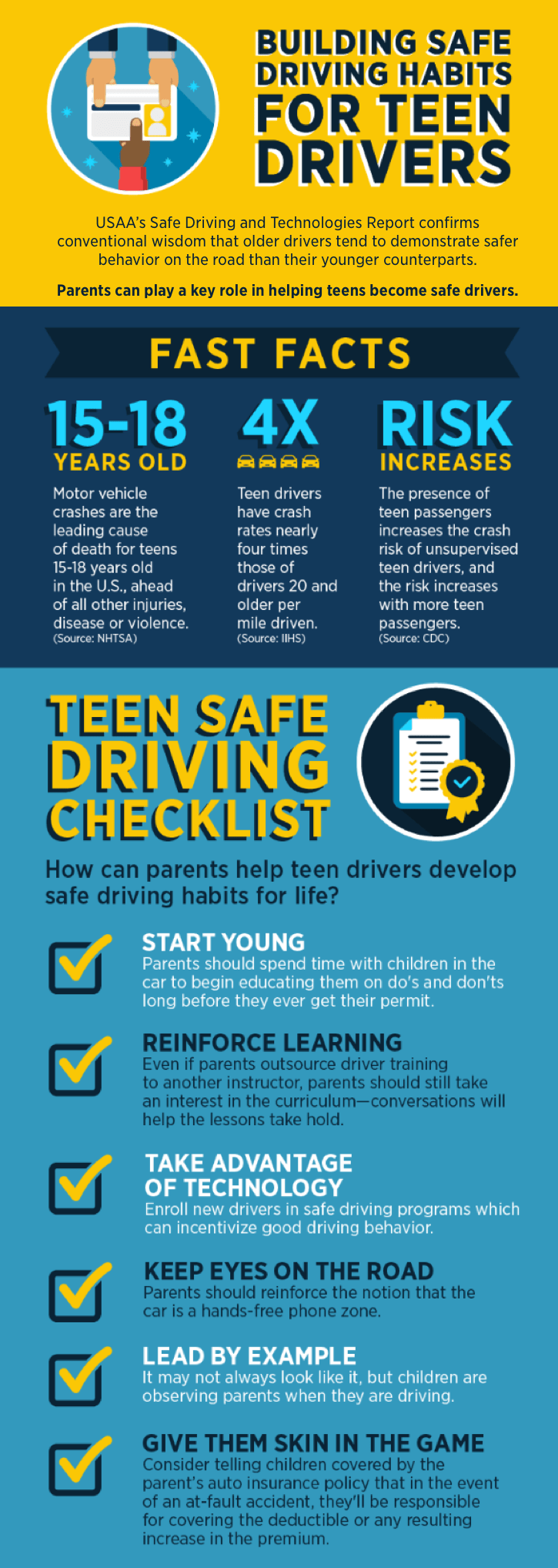

According to statistics, teenage drivers are four times more likely to be involved in accidents than drivers over 20 years old. Car accidents are also the leading cause of death among teens, which means higher insurance policies for teen drivers.

How Much Does Car Insurance Cost? (2023 Rates)

Car insurance for young drivers varies from state to state, but here are some examples of national averages of minimum and full coverage by age:

Comprehensive coverage includes collision and comprehensive coverage, uninsured motorist protection, and increased liability limits. Minimum coverage includes only state-mandated coverage.

The cheapest car insurance rates for 18-year-old drivers are from GEICO and USAA. The average monthly premium in the US is $249 per month, or $1,293 for six months. GEICO provides coverage for $322 per month, or $1,934 for six months. Auto insurers like Travelers, Progressive, and Allstate are excellent insurance providers that offer great rates on your teen’s insurance.

If you are a parent and want to add your 18-year-old child to your insurance policy, there are a few things you should know. Believe it or not, it is cheaper to add your child to your policy instead of getting a separate policy.

Auto Insurance 18

On average, you pay $6,277 a year for separate policies, but if you have your child on your existing policy, you both pay $3,577. You save $2,700 a year by putting your child on a parent policy.

Car insurance for teen drivers is expensive, but there are ways to save money with a full coverage policy. Adding your teen to your policy is just one way to save. You may also have a clean driving record and a clean driving record. Comparing prices is key to getting the best auto insurance quotes.

Many auto insurance discounts help lower your auto insurance premium. There are student discounts for good grades and even discounts if your child goes to school more than 100 miles away. Bundling your home, health, and auto insurance is a great way to save, as is taking a defensive driving course. New drivers save money if they are good drivers to begin with.

There is no maximum compensation regulation for underage drivers. Simple liability insurance will not protect your car. When choosing a full coverage policy, we recommend the following conditions:

Michigan Car Insurance Rates Decline By 18% But Are Still The Highest In The Country

When a teenager drives, it is best to have as much coverage as possible, even when she is driving safely.

One aspect of auto insurance is liability coverage. This covers losses that a teenager causes to people due to an accident. States provide minimum liability coverage. Car insurance is usually not enough. Liability for property damage and hospital visits for bodily injuries add up quickly. You don’t want to be responsible for out-of-pocket costs.

Comprehensive and collision coverage is important if you are financing your car. If you want to lower your premium, it is best to choose a higher deductible amount.

Many different factors affect how car insurance companies determine your car insurance rate. When companies give you quotes, factors like age, gender, location, and even your credit score come into play.

Adding Your Child To Your Car Insurance—top 10 Questions Answered

Younger drivers fall into a certain age group that results in higher car insurance premiums. The better driver you are, the better car insurance rates you will get. Age comes into play because car insurance companies view 18-year-olds as inexperienced drivers and more likely to get into an accident. The average car insurance for teen drivers is higher than for older drivers.

Being a girl saves her from paying higher premiums and deductibles. On average, an 18-year-old man pays more for car insurance than a woman. This is because, statistically, women report fewer accidents and have fewer DUIs than 18-year-old men. Some states have banned the use of gender as a factor in auto insurance quotes, but not all.

Auto insurance companies take everything into account, including location, to give you the best auto insurance quotes. Different cities have different prices, so it depends on your zip code. They determine how much theft and vandalism there is and the accident rate in your area.

Your credit score is a factor in determining average auto insurance rates. Insurers believe that drivers with excellent credit scores are more reliable drivers.

The Best Dui Car Insurance In 2023

On average, an 18-year-old can expect to pay $356 a month in car insurance rates, which works out to $2,136 for six months.

Arizona is one of the most expensive states in the country for car insurance for teen drivers. The average cost of insurance for an 18-year-old woman in Arizona is $4,918 per year.

Insuring an 18-year-old is not cheap. Although insurance is cheaper for 18-year-olds than for 16-year-olds, you will still see a big increase in rates until they are around 25 years old.

No, Pennsylvania does not require parents to add a teenager to their insurance policy. The only requirement is that the vehicle being driven is insured against collision and civil liability. Teens should be insured the day they get their driver’s license, regardless of whether or not they own a car.

Auto Insurance Infographics Stock Illustration

Insuring a teen driver is difficult, but finding affordable car insurance isn’t impossible. It’s important to make sure you have the right coverage in case something happens to your teen while he or she is driving. We hope this article helps you understand your options for purchasing car insurance for your teen.

If you’re ready to get auto insurance quotes, it’s as simple as comparing rates, as amounts vary by company. We have a helpful tool to find the best car insurance options for your young driver.

By Julia Macejkovic Julia Macejkovic, CEO and co-founder of the company, is proud to educate others about auto insurance so they can make informed decisions for themselves and their families. She has been featured in many popular publications where she has helped educate others about the importance of auto insurance. We found the cost of car insurance for 18-year-old drivers using rates provided by Quadrant Information Services. Our data experts analyzed data from every ZIP code in all 50 states, plus Washington, D.C., for the 2017 Toyota Camry LE driven 10,000 miles per year. These rates were for full coverage with the following coverage limits:

Some operators may be represented by affiliates or subsidiaries. Prices provided are sample costs. Your actual quotes may vary.

Auto And Homeowners Insurance Information For Colorado, New Mexico, Utah, Wyoming

The average cost of car insurance for an 18-year-old is $411 per month. That’s $4,931 a year, which is $3,279 more than the average cost of coverage for adults (drivers ages 30, 35, and 45).

Although rates are high for 18-year-olds, young drivers can still find affordable car insurance by comparing rates from different companies. For example, rates for an 18-year-old at COUNTRY Financial are 49% cheaper than the average for drivers this age: $209 per month.

Many of the companies with the lowest car insurance rates for 18-year-olds are not national companies, including COUNTRY. But we discovered that there is also affordable coverage available from USAA, State Farm, and GEICO, which sell auto insurance in almost every state.

Rating How do we rate? Ratings are determined by our editorial team. Our methodology takes into account many factors, including pricing, financial ratings, quality of customer service, and other specific product attributes.

How Much Is Car Insurance For A 18 Year Old? (with Tips)

The cheapest car insurance company for 18 year old drivers is COUNTRY. On average, COUNTRY costs $2,419 less per year for 18-year-olds than the average rate for their age group, nearly half the national average.

COUNTRY is also the best insurance company for drivers over 18 thanks to its discounts. In addition to legacy and multi-pass discounts, COUNTRY offers other savings features designed for young drivers, including:

EL PAÍS also receives very few complaints, according to the National Association of Insurance Commissioners. J.D. Power also recognized COUNTRY as one of the Midwest’s Best Service Companies in its 2021 Auto Insurance Study.

The best overall car insurance for 18-year-olds is GEICO, which has the highest rating of the cheapest companies.

Have You Received A Letter From The State About Your Car Insurance?

GEICO has the cheapest average car insurance rates for 18-year-olds in 13 states. Behind GEICO, USAA is the cheapest airline in 12 states. And COUNTRY is the cheapest company for 18 year olds in Illinois and Oregon.

Depending on where you live, the cheapest rates for 18-year-olds range from $74 to $321 per month.

Hawaii has the cheapest car insurance of any state for 18-year-olds because it doesn’t allow insurance companies to set rates by age.

Louisiana is the most expensive state for 18-year-old drivers, averaging $748 per month for car insurance for 18-year-olds in the Pelican State.

How Many Accidents Can You Have Before Your Insurance Drops You?

In most states, your rates are determined in part by the gender of your license. Car insurance for 18-year-old male drivers is, on average, more expensive than for female drivers of the same profile.

On average,