Cheap Commercial General Liability Insurance – General liability insurance (GL), often referred to as business liability insurance, is insurance that can protect you from a variety of claims including bodily injury, property damage, personal injury, and more. arising from business operations. General liability insurance coverage typically includes:

Learn how small business insurance protects you and what you may want to consider in your personal injury situation.

Cheap Commercial General Liability Insurance

From commercial to general liability insurance, there are a variety of types of coverage that can protect you from claims against your business.

First Things First: Commercial General Liability Insurance

For example, bodily injury covers your business if a customer falls in your home or is injured by a falling object.

It also includes property damage protection, which pays for any damage caused to other people’s property while you’re on the job, and product liability protection, which covers you for illness or damage to your belongings. Covers the case.

There are also personal injury and privacy notices, which protect you against information that contains libel, defamation or copyright infringement. Copyright.

The amount of general liability your business covers depends on things like your company’s goals and contractual requirements.

How Cgl Insurance Is Helpful For Small Businesses?

General liability insurance is often combined with property insurance in a business owner’s policy (BOP), but is also available in many contracts as a stand-alone policy. Together through the Progressive Advantage® Business Program.

As a contractor or small business owner, you need some type of business liability insurance to protect your life.

A mistake can result in a lawsuit that you cannot handle. A good way to protect against this is to make sure you have a liability coverage that matches your exposure.

Some employers or clients may require you to assume a certain amount of public responsibility before working for them.

Commercial General Liability Insurance Quotes In Texas: Houston, Dallas, San Antonio & Austin

If you are a contractor, you may need a general liability instead of just a business policy (BOP). For example, you may not own commercial buildings that require property insurance or pay rent or other expenses. However, you are still exposed to liability risks from your job.

You may be eligible for general liability insurance, without additional BOP coverage, through the Progressive Advantage Business Program. We offer general liability, as well as blanket supplemental insurance coverage to eligible contractors.

Blanket supplemental insurance extends your existing liability coverage to other entities as required by certain contractors and employers.

In 2022, the national cost of general liability insurance through Progressive is $53. Regular price $72.

Public Liability Insurance

Many consumers find their monthly payments are closer to trade-in value because sales prices tend to increase the average price. The rate will depend on the specific area of your business.

Learn more about general liability insurance rates, policy ratings and savings tips to help you find the best balance between cost and protection for your business. Call us or start a quote online.

If you own commercial buildings and other commercial property, you may need additional protections available in the BOP.

No, but not carrying general liability insurance can result in you paying all costs associated with a claim against your business. For example, while visiting your office, a customer slips on the carpet and breaks his hip. Without general liability insurance, you will be fully responsible for all medical bills and legal fees. Therefore, even if it is not required by law, it should be a priority for your business.

General Liability Insurance: Protect Your Assets

I do. You choose your public liability deductible amount when you receive the statement. A deductible is an out-of-pocket expense you agree to pay before your insurance starts paying.

General liability insurance only pays for damages to third parties, not you. You are called the “first party”. A “third party” is someone who makes a claim against you. This means that general liability will not cover theft or damage to your property or equipment.

To protect your property, we offer business property coverage as part of a business owners policy.

I do. Since general liability fees are considered the “cost of doing business,” they are often deductible at tax time. That said, it’s a good idea to consult a tax professional to make sure.

Commercial General Liability Insurance Rates Ppt Powerpoint Presentation Icon Professional Cpb

No way. General liability is only reserved against you for claims made by others for their personal injury or property damage. To protect against claims against you for negligence or wrongdoing, you should have professional liability insurance.

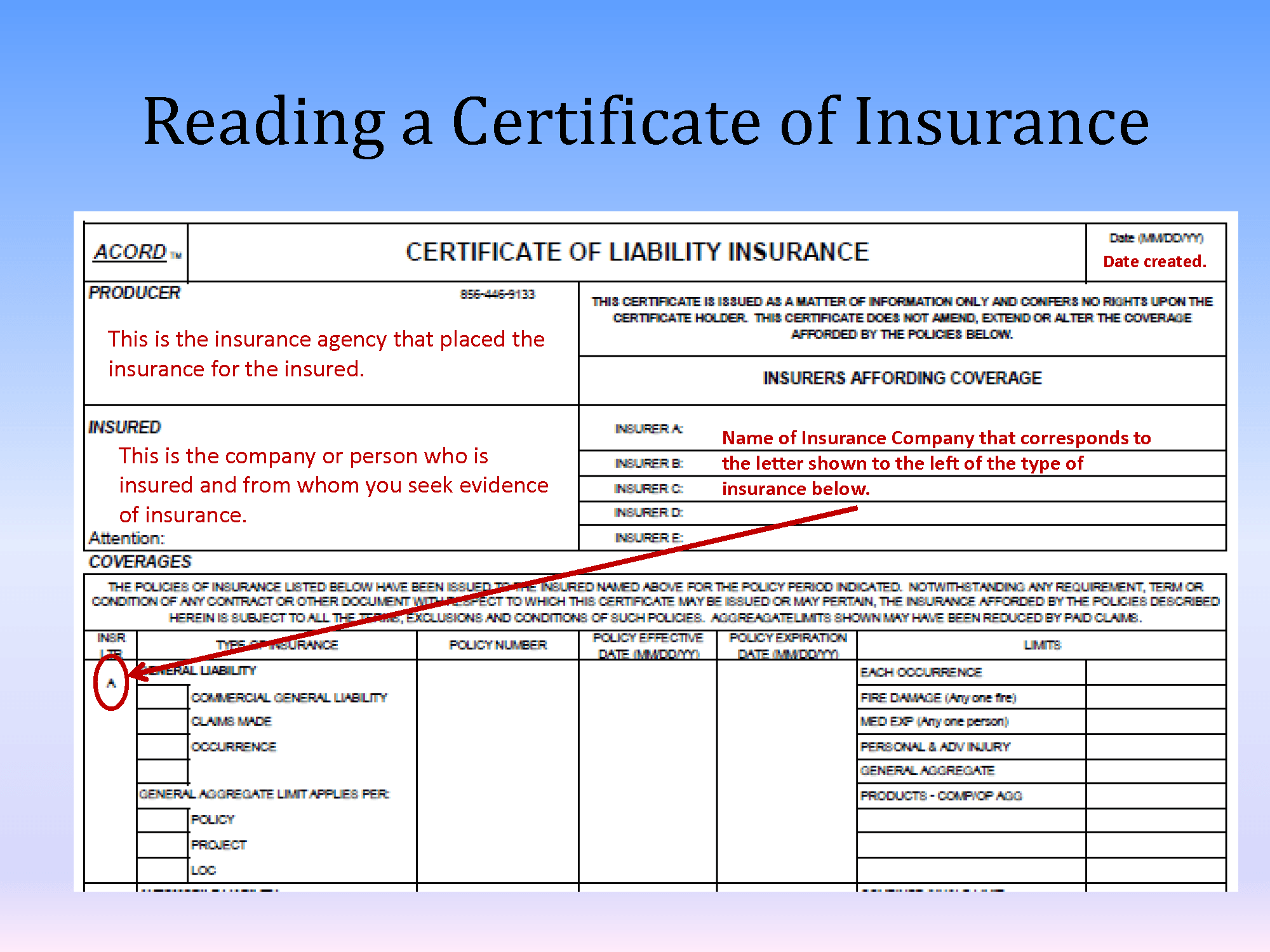

A Certificate of Insurance (COI) is a document that lists all the coverages and limitations on an insurance policy. Basically, it confirms that you have insurance and details of your coverage and limits.

I do. Progressive can help you get business insurance, including general liability, in all states except Hawaii. Search by state.

I do. High-risk businesses can obtain general liability insurance in a specialty market under excess and surplus (E&S) lines. E&S insurance provides coverage for businesses that are not covered by the regular market. General liability insurance helps protect your small business from bodily injury or property damage claims. Without general liability coverage, you may have to pay these claims out of pocket. General liability insurance (GLI) can be called many different things, such as business liability insurance, business liability insurance or general liability insurance (CGL).

How Much Does A Commercial General Liability Insurance Policy Cost?

Just remember that general liability insurance rates are different for everyone because every business is unique. Factors that can determine these costs include:

Did you know that four out of 10 small businesses are likely to experience bankruptcy or public liability in the next 10 years?

Claims range from accidents, such as theft, to accidents, such as a slip and fall after a customer is injured.

A question we hear often: “Does my small business need general liability insurance?” Chances are, the answer is yes. With general liability insurance, you will be protected against claims of:

South Carolina General Liability As Low As $34/month

If a customer injures themselves at your place of business, this policy can help pay their medical bills.

Employees sometimes damage customer property while delivering goods or services. Your GL policy can help cover the loss.

Legal insurance policies can help cover claims for defamation, defamation, wrongful termination and breach of privacy.

If your apartment is damaged in a fire, lightning or explosion, your general liability policy can help pay for repairs.

Commercial General Liability Insurance

Liability insurance helps protect you from general liability claims that may occur during normal business operations, such as:

You may need this insurance if your customers request it. Many customers want to confirm that you have public liability coverage before signing a contract with your business. You can prove that you have general liability insurance with a certificate of liability insurance.

General liability insurance does not cover all types of claims. Depending on your small business, you may need different types of insurance to further protect your business. General liability insurance will not cover commercial vehicle accidents, employee injury or illness, damage to your business, professional errors or omissions, unintentional errors or illegal acts, or any claims that exceed your limits of liability. It also may not cover claims related to a data breach or loss of income if your business is unable to open due to property damage.

State law generally does not require business owners to carry public liability insurance. But it is still a good idea to have this insurance policy. If a customer sues your business and you don’t have insurance, it can put your business and property at risk.

How Much Does Retail Insurance Cost?

It is important to understand your state’s general liability insurance laws. Work with a local insurance agency or our small business insurance team to help you choose the right credit insurance.

Although state law doesn’t require LLCs to carry business liability insurance, it’s a good idea to make sure your business is protected against everyday risks. In addition, you may have to pay out of pocket for claims made against your business, which can be expensive. Talk to an insurance agent or get an online quote today and see how we can help protect your LLC.

When you’re ready to get a general liability report, you want to get the right information. This includes:

Not all insurance companies are the same. It’s important to work with someone you can trust. We have over 200 years of experience helping small businesses protect their companies with insurance such as general liability insurance.

Solved Instructions Explain The Following Insurance Types:

Whether you’re looking for a quote, trying to understand the general rules of class liability or need help filing a claim, we’ve got your back.

To learn more, start a free quote or get your general liability insurance online. We can also help you obtain other commercial products, such as commercial property insurance and commercial auto insurance.

“I was very satisfied with the quote and general liability terms I received for my small business. I recommend TheHartford without hesitation.

“I had a general liability insurance business through Hartford for many years. It is a good product at a reasonable price and the customer service is always there to answer any requests or questions.

Guide To 7 Commercial Insurance Companies For Your Business (2023)

“Good response time. Less than 2 hours after filling out the online form to request a quote for general liability insurance, I called someone from Hartford to set it up.

“I’ve been using Hartford ever since