Cheap Car Insurance For New Drivers – Andrew Hurst Andrew Hurst Senior Director and Licensed Motor Insurance Specialist Andrew Hurst is a Senior Director and Licensed Motor Insurance Specialist at . His work has also been featured in The New York Times, The Wall Street Journal, Forbes, USA Today, NPR, Mic, Insurance Business Journal, ValuePenguin and Property Casualty 360, among others.

Anna Swartz Anna Swartz Senior Managing Director and Auto Insurance Specialist Anna Swartz is the Senior Managing Director and Auto Insurance Specialist and oversees our auto insurance portfolio. Previously, he was a senior reporter at Mic.com and a contributing writer at The Dodo.

Cheap Car Insurance For New Drivers

Fabio Faschi, PLCS, SBCS, CLCS Fabio Faschi, PLCS, SBCS, CLCS Licensed Property and Casualty Insurance Specialist Fabio Faschi is a licensed property and casualty insurance specialist. His expertise in home and auto insurance has been featured in Forbes, Consumer Affairs, Realtor.com, Real Estate, SFGATE, Bankrate, and Lifehacker.

Cheap Cars To Insure For New Drivers

Special Information Special Information This article has been reviewed by members of our Financial Review Committee to ensure that all sources, data and claims meet the highest standards of accurate advice. and prejudice. Learn more about our editorial review series.

The contents follow the correct instructions and complete instructions. Learn about our standards and how we make money.

The cheapest auto insurance for new drivers depends on whether they add on to an existing policy or purchase their own policy. On average, GEICO is the cheapest company for new drivers to sign up for a home policy. For new drivers who choose to purchase their own insurance, State Farm is the best choice.

Car insurance for a new driver can cost thousands of dollars more per year than an experienced driver. But new drivers can still find the cheapest coverage by comparing quotes from multiple companies and considering each mileage or usage-based policy.

Car Insurance For Teens: Coverage And Cost (2023)

There is no definition of who an insurance company considers a new driver. For insurance purposes, this group is not just for young drivers. Instead, a “new driver” can be anyone who:

Despite the lack of experience, newly licensed drivers do not need to purchase another type of new car insurance to meet their state’s insurance requirements. The only difference for new drivers is that their insurance rates will be higher because they don’t have a driving record.

If you are a new driver being considered by an insurance company, the process of buying your car insurance will be the same as for an experienced driver. You can always get insurance from a reputable company.

Young new drivers will have the best luck adding to a family insurance policy, while newly licensed adults can purchase their own insurance.

How To Find Cheap Car Insurance For New Drivers

But for some new drivers, finding your own car insurance can be difficult. It is more expensive, and insurance companies do not always allow newly licensed drivers to fill out an online quote form to get their own insurance. Also, if you are a minor and you want your own car insurance, you must get the consent of a parent or guardian.

Ratings How we measure: Ratings are set by our editorial team. Our methods are based on a variety of factors, including price, product quality, customer service quality, and other product features.

GEICO has the best insurance rates of any company in the entire country for adding new drivers to an existing policy. In addition to low rates, GEICO offers guaranteed benefits such as rental reimbursement and roadside assistance.

GEICO is the best and most affordable auto insurance for families adding a new driver to their current auto insurance. GEICO is not the cheapest, but it is an affordable option in every state. We found that GEICO costs $240 per month, which is $907 less per year than the average for new drivers.

Best Car Insurance For New Drivers: Best Rates (october 2023)

NJM is definitely the cheapest auto insurance for new drivers, but it’s only available in Connecticut, Maryland, New Jersey, Ohio, or Pennsylvania. But NJM’s new driver insurance is only slightly cheaper than GEICO – about $6 a year.

Members of the military, active duty and retired veterans (and their families) can also get new auto insurance from USAA, which starts at $141 a month ($1,076 a year cheaper than the average). But unlike GEICO and NJM, USAA is not open to the public.

Most insurance companies require all licensed drivers in your family to be covered on your auto insurance. Fortunately, adding new drivers to an existing driver is easy.

You can usually add a new driver to an existing policy over the phone or online, on the insurance company’s website or mobile phone.

Best And Cheapest Car Insurance For Teenagers (2023)

You’ll need some basic information to add a driver to your auto insurance policy, including:

New drivers who buy their own policy can get cheap insurance from the State Farm. Because the State Department also lowers rates after an accident or speeding ticket, new drivers may not have to pay. very high prices after a quick mistake.

State Farm offers the best and cheapest auto insurance for new cars to buy their own policy. The average cost of new driver insurance at State Farm is $380 per month, which is $1,632 per year cheaper than the average cost of new driver insurance.

State Farm auto insurance is available in all states except Massachusetts and Rhode Island, but depending on where you live, smaller companies it can be cheap. We found that COUNTRY, Erie, and Auto-Owners all offer affordable car insurance for new drivers.

The Best Cheap Car Insurance For New Drivers

Here are the cheapest auto insurance companies in every state for new drivers—whether you’re adding a new driver’s license to your family car insurance policy or buying it on your own.

Regardless of age or driving experience, anyone moving to the United States is considered a new driver. Since these drivers do not have insurance records with a US company, it is difficult to assess their chances of filing a claim in the future.

While newly licensed drivers will have higher insurance rates, regardless of their experience in their country, their rates will go down if they avoid accidents. and tickets.

Meanwhile, foreign drivers moving to the US can get the best rates from companies that have the cheapest new drivers, including GEICO and State Farm.

Drivers Are Shopping For Cheaper Car Insurance As Costs Rise

If a new driver is an undocumented immigrant, they may still be able to get car insurance, but it depends on where they live. Not all states allow new unlicensed drivers to get a driver’s license—you need a driver’s license to get car insurance.

But the following states allow undocumented new drivers to get a driver’s license and car insurance even without proof of citizenship. These states are:

Car insurance for new drivers is more expensive than average rates for older and more experienced drivers. But finding cheap car insurance is more difficult when you are a new driver and buying your own policy than adding to an existing policy.

On average, private insurance costs $380 a month, or $4,562 a year. That’s almost $2,000 more per year than adding a new driver to an existing policy, which is $230 per month, or $2,763 per year. .

Average Cost Of Car Insurance For Young Drivers (2023)

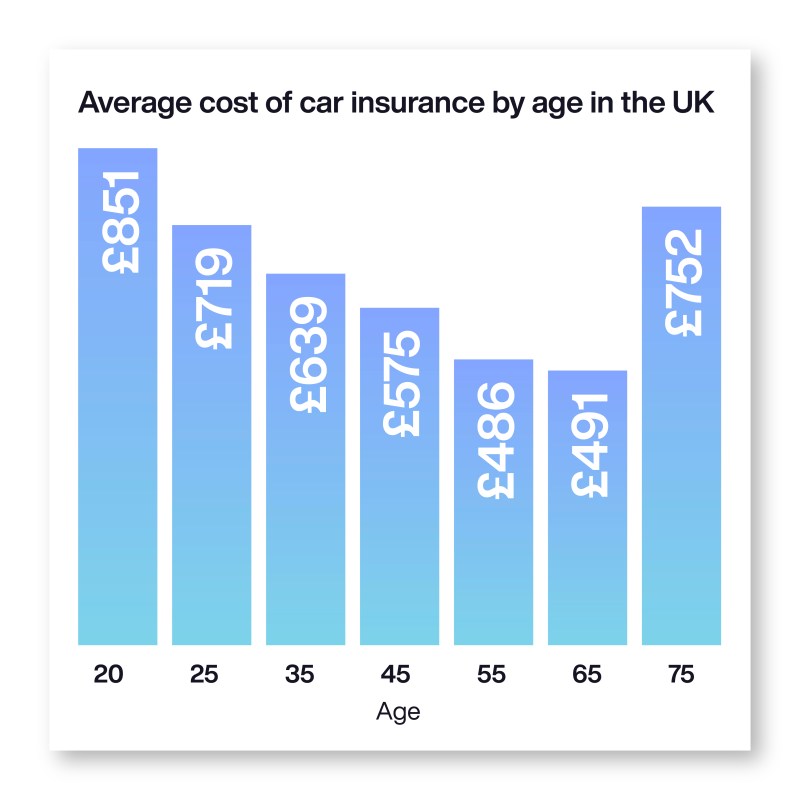

Among major companies, auto insurance for new drivers is $280 more per month than for most older drivers (ages 30 to 45) with independent policies.

There are many reasons why car insurance costs more for new drivers than for experienced drivers. Due to lack of experience, newly licensed drivers are more prone to serious accidents than experienced drivers.

The company also looks at your driving record to see how likely you are to get into an accident. But since new drivers don’t have a track record, companies pay more until they can prove their vehicles are safe.

The best way to find cheap insurance for new drivers is to shop around and compare quotes, but you should also:

Who Has The Cheapest Auto Insurance Quotes In North Carolina?

For new drivers joining an existing program, auto insurance is $2,763 per year. But the annual cost of the policy for a new driver is $4,562.

GEICO offers the cheapest rates for new drivers among the major companies. But you may be able to get the cheapest price through NJM, a regional company that provides services in five states. State Farm offers the best rates for many new drivers with their own insurance. Smaller companies like COUNTRY and Erie also have cheaper rates.

New drivers should shop around for car insurance and compare quotes from multiple companies. They should also be willing to switch companies if their prices become more expensive over time. New drivers can also get cheaper car insurance by taking advantage of discounts or saving money by changing mileage. or user-oriented.

Find out how much auto insurance costs for new drivers using quotes from Quadrant Information Services. These rates correspond to all zip codes in all 50 states and the District of Columbia. Our car insurance model is the Toyota Camry LE Model 10 2017,